How a single tweet crashed a stock market wonder

Good morning, London. Apologies for the delay. Wanted to check in with counsel. These $BUR guys sure do have a guilty look to them, don’t they? https://t.co/XffuPD04QK

— MuddyWatersResearch (@muddywatersre) August 7, 2019

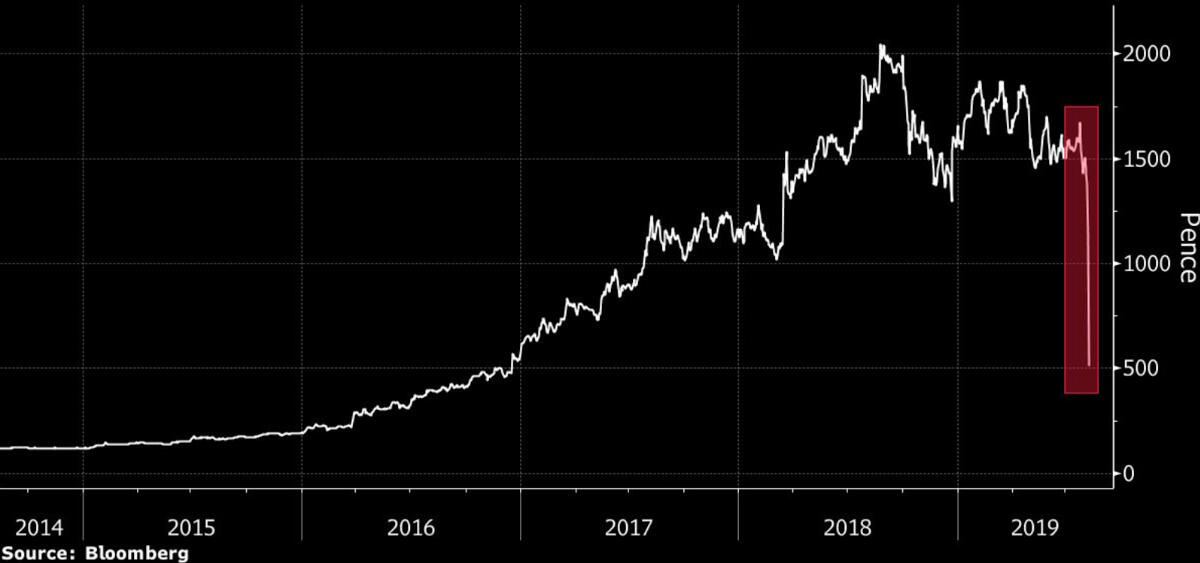

Over a dinner in 2009, as two old law school friends chatted about the problems with how legal cases were funded, a business idea began to form: in return for a portion of settlement or damages payments, a financing company could provide upfront funding for litigation. The potential market was huge.Ten years later, the company founded by Christopher Bogart and Jonathan Molot, Burford Capital, would have offices in New York, London and Chicago, and be worth more than £3 billion. ⁱThis unblemished success story ended in August 2019, with just a single tweet.Shortly after a mere 213 text characters entered the public domain, Burford’s market value collapsed at one point by as much as 72%. ⁱ It has never recovered to its previous levels.

The tweet ⁱ , posted by short selling hedge fund Muddy Waters, pointed to a carefully structured letter ⁱ raising questions about Burford’s accounting and governance. As such, it appeared to follow the standard activist short selling playbook.The market reacted fast. The fall in the price of Burford’s stock was staggering. To most people this appeared to exemplify the role well prepared investment research can play in suggesting problems with public companies.But this explanation is unable to account adequately for why that single tweet was so devastating. It cannot explain the velocity at which Muddy Waters’ investment case permeated the media and the investment community. Most importantly, it can't describe why that investment case was promulgated completely intact and with such longevity that it is so immediately recalled to mind nearly a year later.The answers to these questions are not just relevant to, but absolutely essential for all businesses, organisations and individuals that operate in the public eye. Furthermore, they make salient the critical importance of a new form of analysis and corporate intelligence - the interplay and co-dependence of networks and narratives, and a new discipline - navigating them.

Introducing a new form of corporate intelligence

In a series of three short articles, the Rebbelith team will tell an exciting but important story - a story of how a network of ‘narratives’, some of which were formed decades before Burford existed, combined with an information network to set in motion a chain of events that accelerated and embedded Burford’s crisis and created a kind of communications ‘checkmate’.The first article will introduce the communications challenge posed by investing in esoteric assets. It will then demonstrate the three key, avoidable reasons for why Burford’s communications advisers and publicity agents failed that challenge:

They lacked the technology needed to identify and address the themes in investor-valued media that actually grew around the company. These became embedded and created critical ‘narrative vulnerabilities’.

Some of Burford’s crucial investor messages did not successfully form part of its growth narrative in key investor media because of misjudged announcements and inadequate content.

The company lacked the technology required to identify the media and journalists that were actually valued by its investors.

Figure 4 from series Part One: ‘Pioneers and Complexity’. Mapping the publications and journalists most valued by Burford’s key investors in the summer of 2019

The second article will reveal two dimensions beyond the simple activist short selling playbook that made Muddy Waters’ attack so effective:

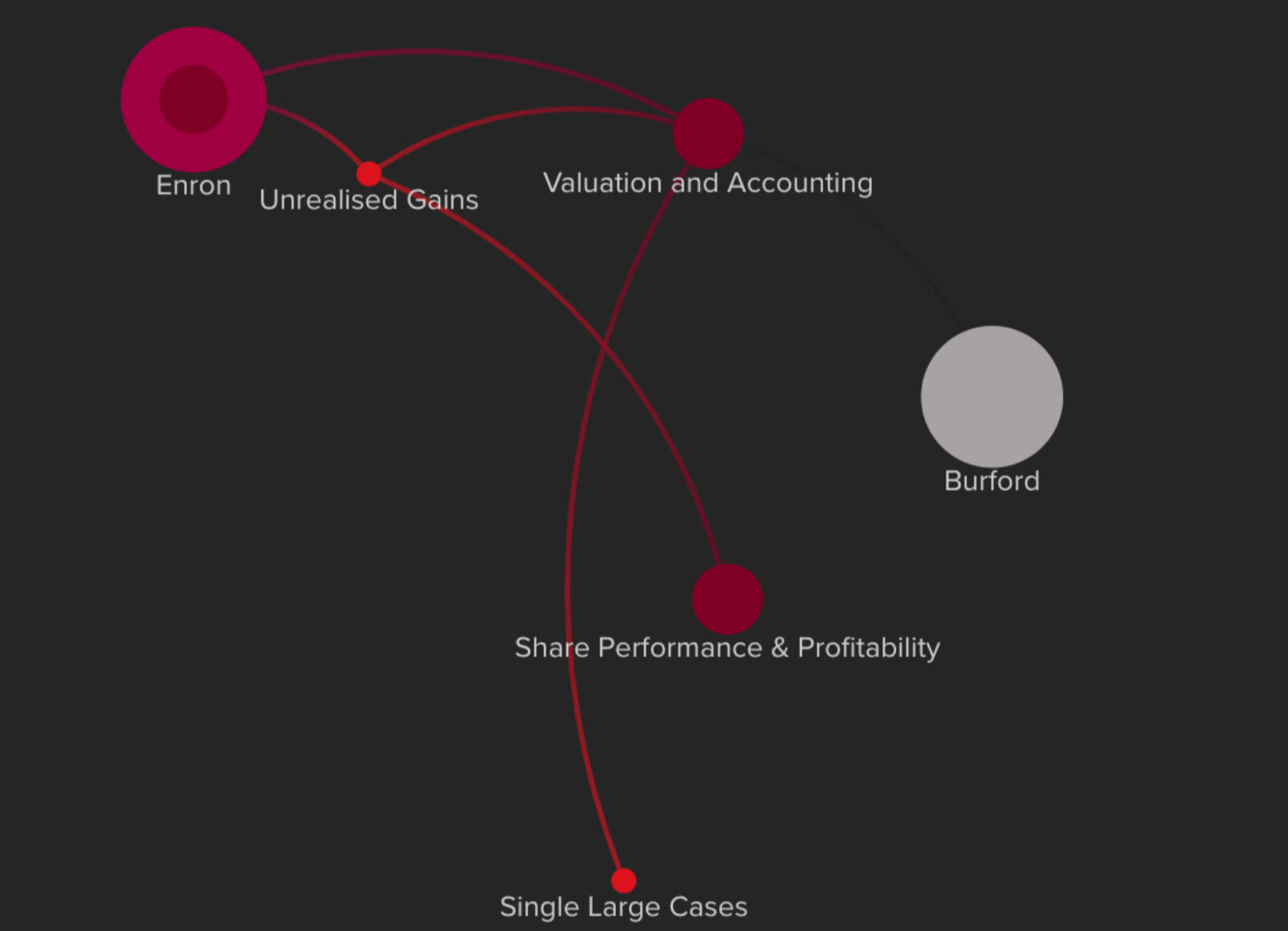

Muddy Waters identified the incredible power of the narratives contained in, orbiting or connected to Burford. They were capable both of realising their individual communications potential and of linking them together to create an inescapable ‘narrative entanglement’.

They had a detailed appreciation of how information networks behave and the different ‘message carrying’ characteristics of particular media channels.

Figure 2 from series Part Two: ‘The Attack’. Creating ‘narrative entanglements’ - invoking Enron as supporting narrative

The third and final article will explore why Burford’s responses were ultimately ineffective. It will then show how a modern, data-backed approach to communications could have helped. These themes will be discussed in three assessments and one suggestion:

Burford’s admirable but ultimately ineffective technical rebuttal - released the day after the attack.

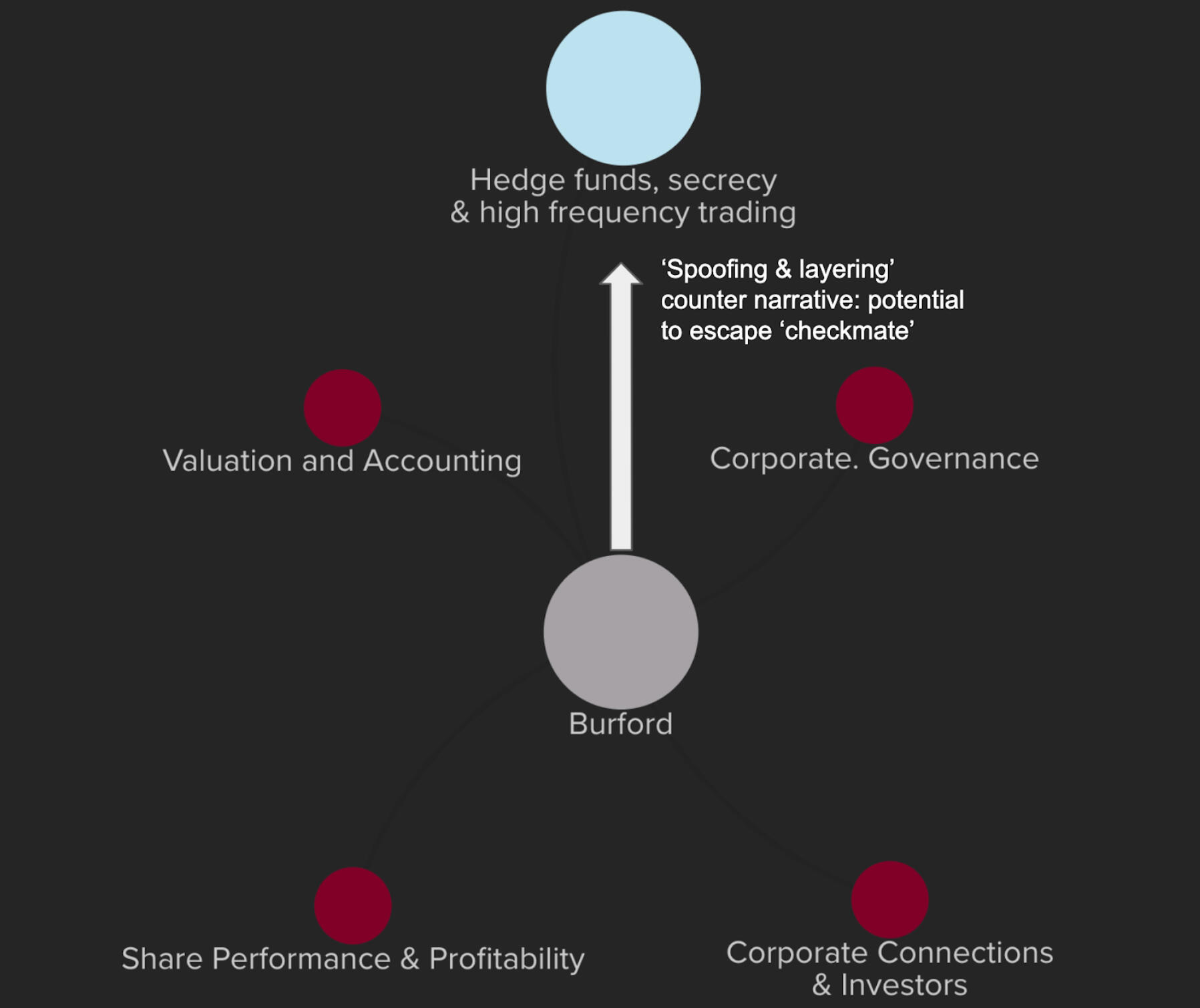

The significant but squandered opportunities contained in the ‘spoofing and layering’ counter narrative the company launched.

How the ‘communications checkmate’ affected further responses.

Suggesting a modern, data-backed and visual approach to building an effective communications strategy for an investor facing business.

Figure 2 from series Part Three: ‘Checkmate’. Burford’s August 12th ‘Spoofing and Layering’ counter narrative - potential to escape ‘checkmate’

The importance of networks, narratives and navigation

Through these three articles we will show why narrative and network intelligence must become an integral part of reputational, brand and communications strategies for every organisation. Like the original Rebbelith maps from which we draw our heritage, we will explain how the media and stakeholder discussions that occur in the modern world can now be charted and navigated confidently.

Next time...

In Part One: Pioneers and complexity, the Rebbelith team will reveal the three key, avoidable reasons for why Burford’s communications advisers failed the communications challenges of investing in esoteric assets.The article will show readers how ‘narrative vulnerabilities’ began to grow unchecked around the company, and it will explain why some of Burford’s investor messages didn't end up forming part of its growth story.Finally, Rebbelith will assess Burford’s media outreach strategy to show how much potential value could have been realised by their communications advisers.

Thank you

We will be in contact shortly.In the meantime, why not have a look at our brochure?